Convenient and secure payments

FDIC-Insured - Backed by the full faith and credit of the U.S. Government

Account Access

Online & Mobile Banking

Manage your money anytime, anywhere.

Online Banking

Check balances and see transactions in real-time 24/7.

- View e-Statements – sign up in Online Banking

- Pay bills in one central location, no stamps or envelopes

- Download transaction history to Quicken or Microsoft Money

- Make transfers to your Farmers Bank & Trust accounts or loan payments

- Transfer to and from your accounts at other banks

- Transfer to friends and family with Zelle®

- View end of year tax forms under Documents

- Get your Credit Score and more with Credit Sense

Mobile Banking

FBT Mobile makes banking quick and convenient on your phone or tablet.

- All the convenience of online banking at your fingertips

- Text banking available

- Turn on Instant Balance to get a quick balance without logging in

- Turn on fingerprint login for super-easy access on compatible device

- Get your Credit Score and more with Credit Sense

- Add your Farmers Bank & Trust debit card and set alerts, track spending and more!

Message and data rates may apply.

Online Bill Pay

Simple, secure way to pay all your bills in one place.

- Schedule one-time or recurring payments

- Pay anyone with a US mailing address

- Receive your bills securely in Bill Pay

- Receive notifications when your bills are due

- Available in Online Banking

Updates to browsers may affect your access to Bill Pay. See our

Bill Pay Browser Settings document with suggested settings to utilize full functionality of online Bill Pay.

Mobile Deposit

Simple and secure option to deposit checks from your mobile device.

Four Simple Steps

- Open the FBT Mobile App and choose Deposit.

- Choose the account and enter the deposit amount.

- Take photos of the front and back of your endorsed check.

- Submit the deposit. Tracking and confirmation available in History.

You will be notified by email once your application is approved. Subject to eligibility, restrictions apply.*

*To qualify for mobile deposit applicants must have an open and active checking or savings account (Courtesy Accounts do not qualify), and must not have had a prior history of account abuse. Accounts considered repeatedly overdrawn may be subject to lower daily deposit limits. Repeatedly overdrawn is defined as having been overdrawn six or more banking days or by $6,725 or more on two or more banking days within the preceding six months.

Message and data rates may apply.

e-Statements

Get organized with e-Statements. Sign up for this FREE service through online banking to provide quicker and easier access to your account statements.

- Fast – view statements as soon as they are available, no mail time.

- Secure – no items in your mailbox, less chance of identity theft.

- Convenient – anytime, anywhere view and print current and previous statements.

- Simple – reconcile your accounts by effortlessly downloading to Quicken or Microsoft Money

How Do e-Statements Work?

It's simple! Receive email alerts automatically notifying you when your statement is ready to download. Then log into Online Banking to retrieve your e-Statement from the Documents button within the account view.

How Do I Sign Up?

Simply sign into Online Banking, go to Profile and sign up under the Electronic Statements section.

Text Banking

After enrolling in Text Banking from the Profile section of Online Banking, simply text the following commands to 99588 to receive details in seconds about your account:

- Check Balance - Text BAL

- View Account Activity - Text HIST + Account Nickname

- Locate an ATM - Text ATM + street or zip

- Locate a Branch - Text Branch + street or zip

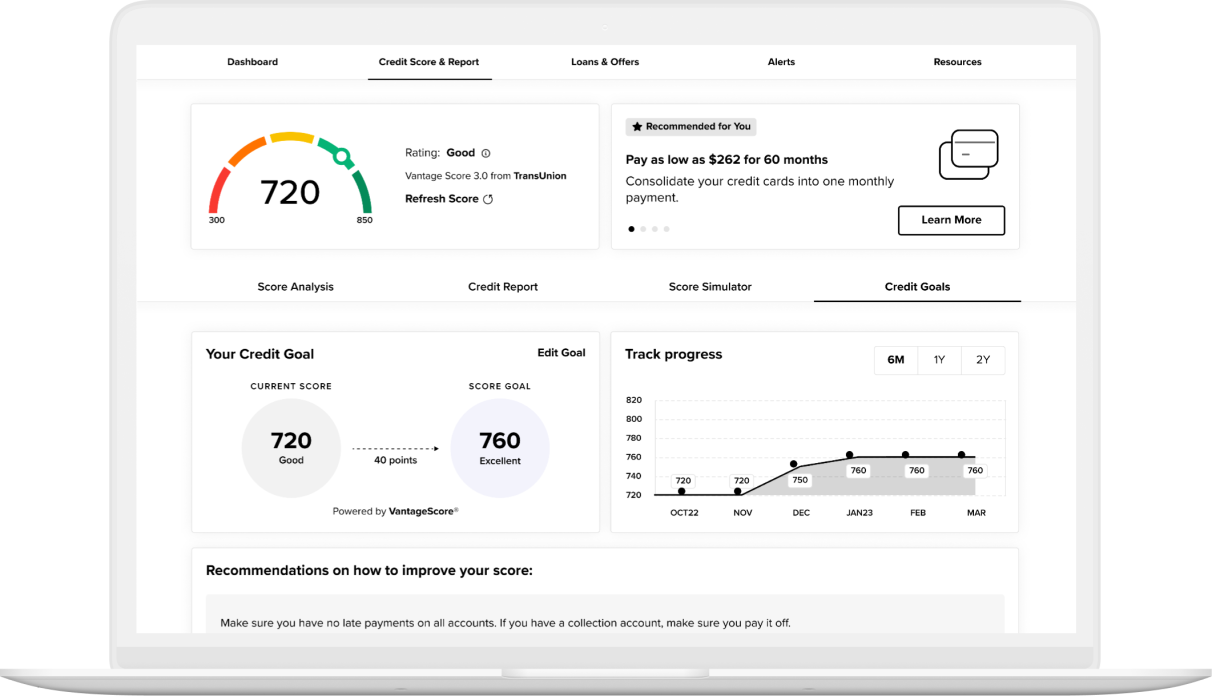

Credit Sense

Access your credit score, full credit report, credit monitoring, financial tips, and education. All of this without impacting your score.

- Daily Access to Your Credit Score

- Real Time Credit Monitoring Alerts

- Personalized Credit Report

- Credit Score Simulator

Log in to online or mobile banking and click on the Credit Score widget to get started.